The High-Stakes Pivot

In the high-velocity paddock of Formula 1, walking away from £30,000,000 is usually considered financial malpractice. Yet, McLaren Racing has done exactly that, tearing up its lucrative contract with Castore to pursue a partnership that prioritizes operational excellence over upfront guarantees. This counter-intuitive move signals a massive shift in sports commercial strategy: the realization that a massive sponsorship check is worthless if the backend logistics cannot deliver a shirt to a fan in Austin or Abu Dhabi. By choosing "Supply Chain Sanity" over "Headline Cash," McLaren is betting that a more robust retail engine will yield higher long-term dividends than a top-heavy sponsorship fee.

Brand Equity is More Valuable Than a Sponsor Fee

McLaren is currently executing what insiders call a "Flight to Quality." For the team’s leadership, the decision to dump Castore was a strategic defense of the brand's most valuable asset: its reputation. Under the previous arrangement, persistent supply chain delays and inconsistent garment quality were not just logistical headaches—they were actively eroding fan trust.

The spreadsheet logic here is cold and calculated. While Castore offered a premium headline figure, the reputational cost of dissatisfied fans and faulty merchandise created a deficit that cash couldn't bridge. As McLaren targets a premium global audience, they can no longer afford the "startup pains" of an over-extended partner.

"McLaren is trading 'Headline Cash' for 'Supply Chain Sanity' as they terminate a £30m deal to bet on Puma's global retail engine."

The 'Lifestyle' Ceiling vs. Pure Performance

The pivot to Puma is a direct response to the "Lifestyle bubble" currently inflating the value of sports brands. While Castore’s performance-only focus served the technical needs of the garage, it hit a hard ceiling regarding cultural relevance. In contrast, Puma’s ability to "cross-pollinate" with streetwear and high-fashion icons—evidenced by their high-profile collaborations with A$AP Rocky—elevates McLaren beyond the racetrack.

This move effectively transforms McLaren from a pure sports entity into a global lifestyle brand. By tapping into high-margin lifestyle apparel, the team can access a broader consumer base that views F1 through the lens of fashion and status rather than just lap times.

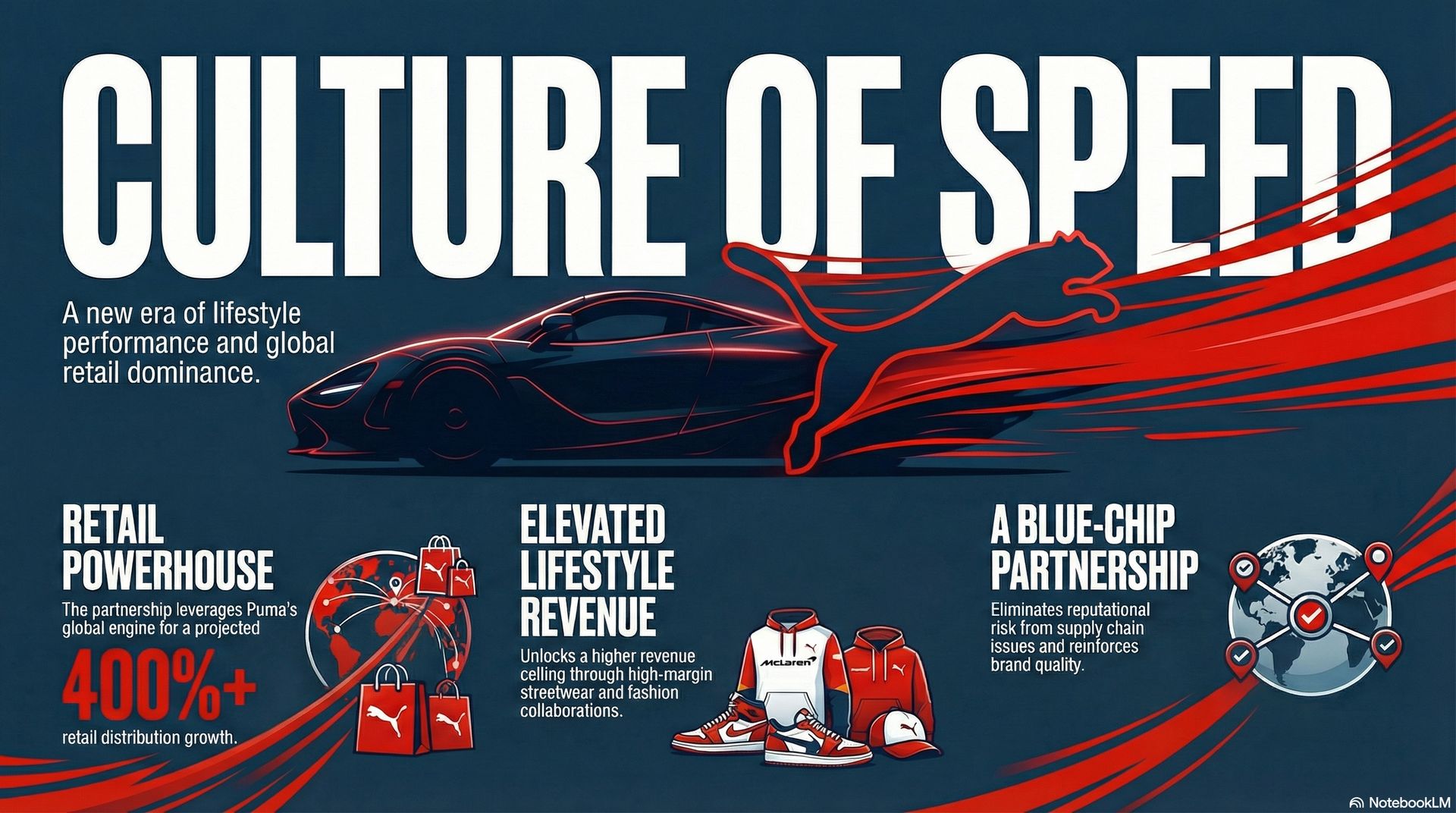

The 400% Growth Engine

The financial architecture of this deal is a masterstroke in Net Present Value (NPV) management. While the base fee from Puma may be lower than the Castore contract, the "Plug-and-Play" logistics engine Puma provides is vastly superior. Crucially, Puma solves a multi-series logistical nightmare: McLaren must manage complex SKU requirements across F1, IndyCar, and WEC simultaneously. Castore simply couldn't build the infrastructure fast enough to handle that volume.

The move also slashes internal costs by eliminating massive customer service overhead previously dedicated to managing fan complaints and returns. When you factor in a projected 400%+ growth in retail distribution and a 15-22% rise in licensing royalties, the deal is expected to be NPV positive within just 24 months, even after accounting for any potential break fees. Furthermore, the move weaponizes the personal brands of the drivers:

• Lando Norris & Oscar Piastri: Both drivers gain unprecedented global exposure through Puma’s "Culture of Speed" marketing campaigns.

• Retail Presence: Driver-specific gear will now be stocked in thousands of global retail doors, a feat impossible under the previous regime.

The Consolidation of the Paddock

This shift highlights a broader trend: the consolidation of the F1 apparel market. Puma is effectively building a vertical monopoly, adding McLaren to a powerhouse portfolio that already includes Mercedes and Ferrari. This "Puma-fication" of the paddock suggests that F1 teams are prioritizing stability and scale over the aggressive, often over-extended growth models of challenger brands.

For the rest of the market, the loss of a flagship partner like McLaren is a loud signal. It suggests that Castore may have scaled too fast, leaving them unable to meet the sophisticated demands of a top-tier racing operation. As teams become more global, they are returning to established giants who have already mastered the "last mile" of retail.

The North American "Drive to Survive" Legacy

The ultimate prize in this partnership is the North American market. By leveraging Puma’s entrenched presence in US malls and premium sports outlets, McLaren is positioning itself to be the dominant F1 brand in the United States. They are moving to capture the "Drive to Survive" audience exactly where they shop, rather than relying on inconsistent e-commerce fulfillment.

The transition follows a disciplined strategic timeline:

• 2025: A massive "Fire Sale" of legacy Castore inventory to clear the retail channels.

• 2026: A total "marketing reset" coinciding with the debut of the full Puma x McLaren collections.

Conclusion: A New Era for F1 Merchandising

McLaren’s departure from a £30M deal marks the end of the "Headline Cash" era. In its place is a new maturity in sports commerce—one that values the integrity of the supply chain as much as the value of the sponsor's logo. As McLaren bets on global infrastructure to drive its next phase of growth, it leaves the rest of the grid with a difficult choice. Will other teams continue to chase the highest bidder, or will they follow McLaren’s lead and trade short-term sponsorship checks for long-term "Supply Chain Sanity"?